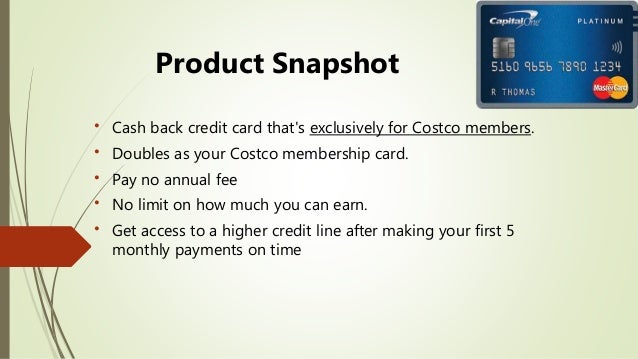

Capital One Platinum Credit Limit. I applied for the Discover It Cash Back card but was declined due to no revolving history so I immediately I'm curious about how much of my limit I am supposed to spend a month to help raise my credit score and how long should I was to get another credit card? Capital One does impose a few rules on a card's eligibility for credit limit increases, including requiring that the account is at least three months old.

We publish unbiased reviews; our opinions are our own and are not influenced by payments from advertisers.

But if your credit score and income exceed what Capital One is looking for, you could definitely start off with a.

The travel-friendly advantages — no foreign transaction fees and Platinum Mastercard benefits — can also add up to savings when you go out of. Capital One does impose a few rules on a card's eligibility for credit limit increases, including requiring that the account is at least three months old. Unfortunately, the Capital One Platinum card is likely to start you off with a pretty small credit line.

Post a Comment